Lebanon has swiftly initiated a legal and procedural compliance process in response to what officials described as “very serious” US demands to curb terrorism financing, after a visiting US Treasury delegation delivered the requests to political and monetary authorities earlier this week along with warnings of possible sanctions.

The measures, which come with defined deadlines, explicitly target the drying up of Hezbollah’s funding channels and those of its affiliated organizations.

On Friday, the Central Bank of Lebanon (Banque du Liban) took what it described as “the first step in a series of precautionary measures aimed at strengthening the compliance environment within the financial sector,” amid speculation over the direction of government and ministerial steps in the same area.

Observers note that these moves extend beyond technical considerations and touch on the politically sensitive issue of controlling weapons exclusively.

The central bank’s initiative includes “applying precautionary measures to all nonbank financial institutions licensed by Banque du Liban, including money transfer companies, exchange houses, and other entities handling cash transactions in foreign currencies to and from Lebanon.”

Closing Hezbollah’s Financial Loopholes

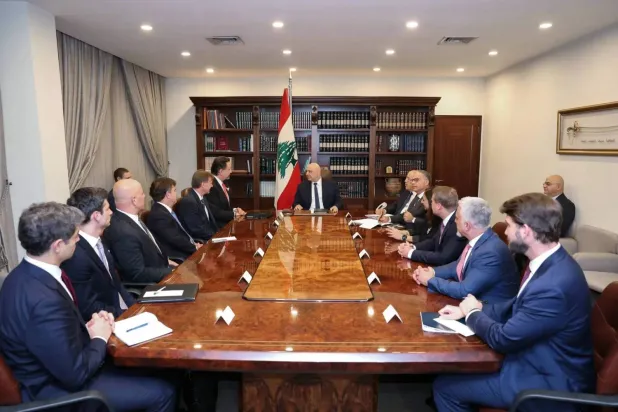

This initiative aligns with information obtained by Asharq Al-Awsat from meetings held by the US Treasury delegation with Lebanon’s presidential, ministerial, parliamentary, and central bank authorities.

The meetings emphasized the need for strict measures to close loopholes used to channel funding to Hezbollah and its institutions, and to curb unregulated methods exploited by the group.

These include money transfer and exchange companies, illicit trade operations, many conducted in cash, gold, and some using cryptocurrencies, according to the delegation.

John Hurley, the Undersecretary of the Treasury for Terrorism and Financial Intelligence (TFI), spoke to journalists during a limited meeting at the US Embassy in Beirut.

Sources indicate that the next steps by the central bank will focus on promoting electronic payments in retail sectors, whether through cards, smartphones, or online internal and international transfers connected to secure banking networks.

These systems are subject to standard “know your customer” (KYC) requirements, helping control cash flow by regulating dollar liquidity, including part of the cash distributed monthly by the central bank for public sector salaries and banks’ contributions to depositor allocations, as per circulars.

Domestic Political Dimension

Financial sources familiar with the move said the measures were designed to avoid domestic political fallout and to prevent provoking the concerned political party. The steps are framed strictly as part of Lebanon’s effort to be removed from the Financial Action Task Force (FATF) “grey list.”

The central bank noted that “inclusion on this list indicates gaps in combating illicit financial transactions, triggering tighter international scrutiny and lowering confidence among global financial institutions.”

In a clarification responding indirectly to the Treasury delegation’s request for tighter controls over cash moving outside traditional banking channels, the central bank said the protective measures aim to “prevent the transfer of illicit or illegally obtained funds through these institutions, by imposing stricter compliance requirements and enhanced due diligence on all legal and natural persons involved in cash transactions, including ultimate beneficiaries.”

Additional Precautionary Measures

The central bank indicated that further steps will impose additional precautionary measures on commercial banks, aiming to “establish multiple layers of controls and checkpoints to detect, contain, and prevent illicit funds from circulating through the banking system and the broader financial sector.”

Lebanese Justice Minister Adel Nassar met with the US Treasury delegation in Beirut.

The Banking Control Commission will oversee the implementation of these measures and ensure all banks and nonbank financial institutions comply, taking corrective action as needed.

Under the central bank’s basic decision attached to Circular No. 3, nonbank financial institutions are now required to collect detailed client and transaction information for all operations of $1,000 and above, and to update KYC records according to attached templates for natural and legal persons as well as ultimate economic beneficiaries.

The circular mandates that institutions submit the required data to the central bank in encrypted form within two business days of the transaction.

Deadlines for implementing new procedures include adopting templates for cash transactions and new clients by the beginning of next month, with full compliance for existing clients within six months of the circular’s issuance.

The central bank warned that violations would expose institutions to sanctions under Article 208 of the Lebanese Code of Money and Credit, ranging from warnings to license revocation, in addition to fines and criminal penalties.